Below you’ll learn five ways to save money and cut household costs today!

Most of us are trying to cut costs every which way we can, but one place we often forget or ignore is household costs and expenses.

You may be wondering how so many could forget an expense this big, it’s not that people don’t think about it.

The problem is when we think of cutting costs, we never think of all parts of the household we spend money on.

We forget there are way more expenses than electricity, rent, and groceries. I mean, what about insurance, shopping of any kind, and even pet food?

We often think we have the best deal in these areas, or there’s no way to cut costs down.

So when we’re trying to figure out how to cut costs, we often think we’re doing everything we can, but we actually aren’t.

At this point, you may be wondering what the household costs are and how we can reduce them.

Well, they can be different for everyone, of course.

It all depends on where you’re at in life or how big your family is, but most people have the same main ones, and they include:

- Insurance

- Rent/Mortgage

- Subscriptions

- Groceries

- Utilities

- Pet care

- Cell phone bill

- Cable

- Streaming services

- Credit cards

- Gym membership

- Car/Transportation

Now that you know the main household categories, let’s start saving!

Here are 5 Ways to Cut Household Costs!

Look At Your Bills

The first way to start cutting your bills and expenses is to look at your accounts.

By knowing what you’re paying for and how much, you can then determine what needs to go.

You never know how much you’re truly spending on clothes and eating out until you track it.

Another thing that can occur is you might have thought you canceled something, but you never actually did.

You could have even been double charged or billed for a higher package than you have.

This is why looking at your bills alone can save you a ton.

I know someone who moved, and when they set up their internet, the company made two accounts, and on top of that, they were being billed extra for things they didn’t request.

This went on for a year before they found out that if they had gone over their bills, this wouldn’t have happened.

Reduce Expenses

Once you know what you’re paying for, you can start cutting things down or even out.

I suggest starting with your subscriptions; everyone has at least five in this day and age.

When going over each one, whether it’s for an app, streaming service, or music-related, think about how often you use it and whether there is a free version.

I know most music apps have free options; you just have to listen to ads.

Regarding streaming services, think about how many you really need.

One alone has enough shows and movies to entertain us, and if you have cable on top of it, decide which one you rather have. You don’t need both.

If you have a gym membership, see if they have a lower amount you can pay or look into cheaper gyms to save even more.

But if you’re really looking to save, cancel your membership and work out at home.

Another household cost you can cut is insurance, and this includes a car, home, health, and life.

Look over your contract and talk to a representative to see if you can get a cheaper plan.

It’s also a good idea to look elsewhere, but let your provider know you’re looking at other companies.

They hate losing customers. This tip also applies to your utility bills.

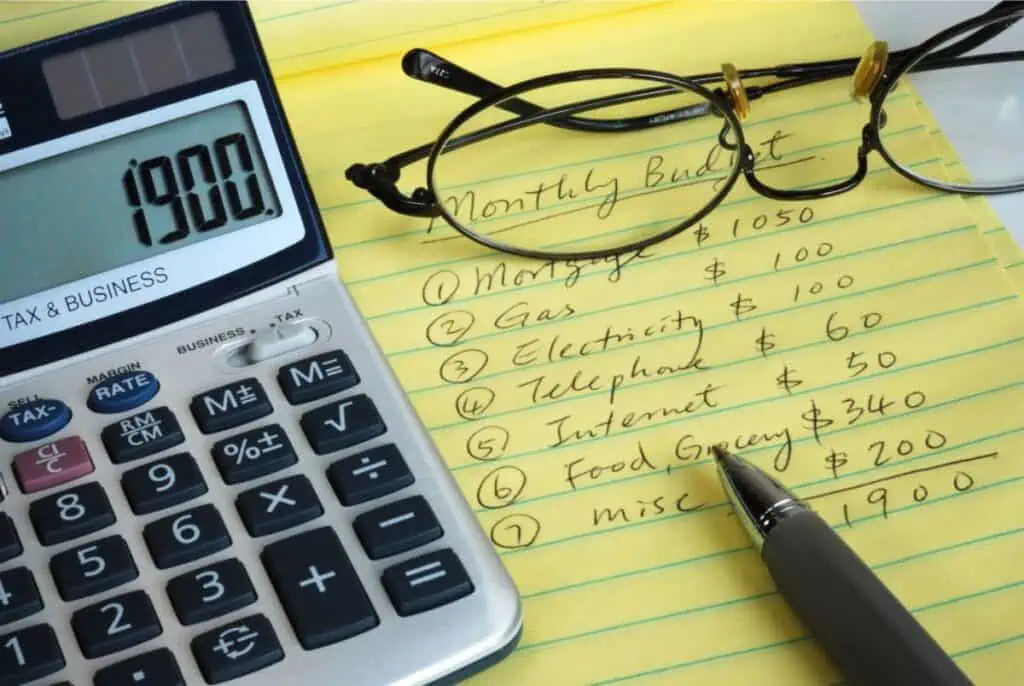

Start A Budget

Making a budget is a great go-to tip for many and for good reason.

Grab a FREE Printable Budget Worksheet

Making categories for your expenses makes it easier to see how much you’re spending on groceries, bills, and shopping. etc…

But budgets can do way more than that; they can help you not overspend and can also allow you to save for emergencies, trips, wants, or the future.

To make a budget you can stick to, go back over your bills and see what you spent your money on last month as well as how much you spent on everything else.

Then make the budget a lower amount than what you come up with.

Be sure not to go overboard.

If you spend $200 on shopping, cutting it down to $15 will result in failure because it’s too much, too soon.

Make it easy for you to transition so you can stick to it easier.

If you did the first two tips, making a budget is even easier since you won’t have to weed out as many expenses.

Fix And Reuse

Anytime anything breaks, our first thought is to buy a brand-new one.

That doesn’t have to be our go-to thought process.

There are people who can fix things cheaper than buying a new one, and there are places you can buy used ones and save a ton.

Find a local shop or person you can use to get it fixed, and if that’s not an option, look for one at a thrift store or check on apps like Offer Up.

Even Craigslist is a good place.

Sometimes they’re even free.

This method goes for anything in your home as well as clothes.

If you rip a seam or need something taken in, go to your local tailor and have them fix it.

This can save you a ton by itself.

Do It Yourself

Now I’m not talking about everything; I do agree some things are better off with professionals.

What I mean is there are many things we pay for but could easily do ourselves, such as yard work.

If you’re physically capable of doing it, you should.

That money is better spent elsewhere.

The same goes for house cleaning; on that note, you can even make your own cleaners.

It’s super easy and will save you a ton.

You could apply this method to cooking.

Instead of buying pre-cut veggies or already seasoned meats, go for the cheaper option and prepare them at home.

Spending more time in the kitchen with family can be a good thing, forgo the convenience and enjoy preparing food with your family.

Just take a minute to think about it before you pick up your phone to call someone to paint that room or mow your lawn, and see if you can do it yourself.

There is a multitude of YouTube videos that can show you how to do anything from installing a carburetor to saving money at the grocery store.

These ways you can cut household costs are just the beginning.

Once you start doing these things you’ll find more ways you can save and you’ll be glad you did.

Leave a Reply