Use this free printable budget planner to help you take control of your finances once and for all.

Using a planner like this one will take something that might be overwhelming you and make it so simple to track and see your successes.

If you want to know How to Save Money, read more below.

Free Printable Budget Planner

Creating a budget can be overwhelming and complicated much less sticking to that budget!

It doesn’t have to be, however, and keeping things simple is a great way to get your finances in order.

Here are a few tips for creating and sticking to a simple family budget using this monthly budget planner.

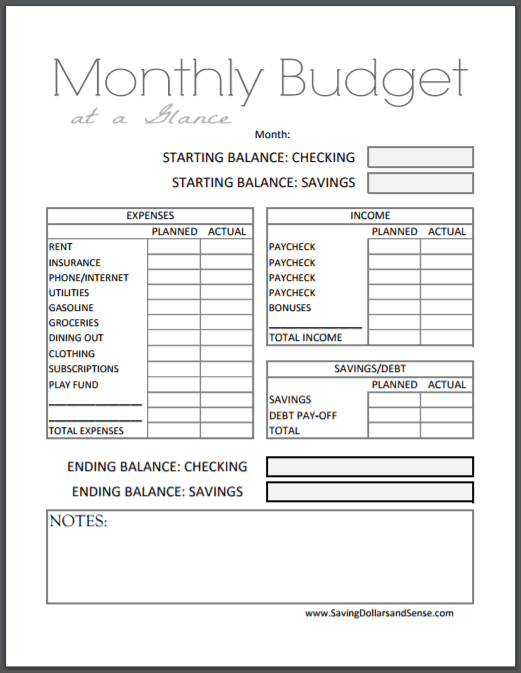

How to Use This Budget Planner Worksheet

- Start With Your Income

Write down all sources of income for the month (paychecks, side income, etc.). - List Monthly Expenses

Fill in your expected expenses like rent, utilities, groceries, and transportation. - Compare Planned vs Actual Spending

At the end of the month, record what you actually spent and note any differences. - Set Savings Goals

Use the savings section to plan for emergencies, vacations, or long-term goals. - Review & Adjust

Look back at your notes and adjust your budget next month based on what you learned.

Check Your Spending

Take a copy of the last three to four months of your family’s bank account statements.

Go through each line item and jot down what that money was spent on such as fast food, groceries, bills, etc.

Create a total for each month of the amounts that you spent in each category.

This will give you an idea of what your budget should look like and what areas you can focus on decreasing your spending.

Budget Your Expenses

Once you have a better idea of where your money goes each month, you can make a simple a realistic budget.

First write down your planned income from regular job pay, money made from side ventures, bonuses, etc.

Then write down the expenses that happen without question each month such as rent or mortgage, utilities, and so on.

The money that is left over from after you deduct your monthly expense from your income is the money you can play with a bit in your budget.

Be realistic with this budgeting based on the money you’ve spent in the last three months, but also challenge yourself to spend less in the areas that you are able to.

For example, if you’ve spent $200 on average the last three months on fast food, you could challenge yourself to reign in that spending by budgeting only $150 or $100 for a fast food/eating out budget this upcoming month.

Create Savings Goals

The greatest motivation for creating and sticking to a budget is to have financial goals for saving money.

Once you’ve determined your income and spending goals for the month, determine what you’ll do with the remaining balance.

You should budget part of that money to pay off debts and part of it to save for a rainy day.

Dave Ramsey, who is an incredible financial advisor, suggests that before paying off debt you save $1,000 into an emergency savings fund.

Once that is saved, he recommends that you begin paying off debt aggressively.

The perk of creating a budget is the peace of mind that comes with getting yourself and your family out of debt and then being able to save money for the future.

Now Write it Down

Once you have created your budget and set some savings goals, start writing it all down!

I’ve included a free budget sheet that you can use to keep track of your goals and actual spending. Writing down your goals is a great way to begin achieving them, especially where spending is concerned!

Keep a spending journal and write down every single cent that you spend.

This habit will help you to be more aware of your spending and you’ll be less likely to spend money on unnecessary items when you aren’t spending absent mindedly.

Creating and sticking to a family budget is the first step in creating financial peace for your family.

Budgets do not have to be complicated and overwhelming. With the simple steps outlined above, you can get on the right track to budgeting your finances and creating financial peace.

Please use this free budget planner worksheet to help organize your plan today!

How to Use the 50/30/20 Budget Rule With This Printable

If you’re not sure where to start with budgeting, the 50/30/20 rule is a simple and flexible way to plan your money without feeling restricted.

Here’s how it works:

50% Needs

This portion of your income goes toward essentials like housing, utilities, groceries, insurance, transportation, child care, and minimum debt payments. These are the things you truly need to cover each month.

30% Wants

This category is for non-essentials that make life enjoyable, such as eating out, entertainment, subscriptions, hobbies, and shopping. Budgeting for wants helps prevent overspending and guilt.

20% Savings and Debt Payoff

This last portion is for your financial future. It can go toward an emergency fund, sinking funds, credit cards, student loans, retirement savings, or extra debt payments.

How to Apply This Rule Using the Printable Budget Planner

- Start by writing down your total monthly income on the planner.

- Calculate 50%, 30%, and 20% of that amount.

- Use the budget categories on the worksheet to organize expenses into needs, wants, and savings.

- Adjust your spending if one category is taking up more than planned. Small changes make a big difference over time.

A Gentle Reminder

The 50/30/20 rule is a guide, not a rulebook. Some seasons require more flexibility, and that’s okay. The goal is progress, not perfection. This printable budget planner is here to help you understand your money, make intentional choices, and feel confident about where your dollars are going.

I thank you so much. am also sharing this my daughters. I have enjoyed reading your blog.

Thank you, you are so kind 🙂